Minnesota Quit Claim Deed: What Is It?

A quitclaim deed is a legal tool that is used to transfer interest in real property. The person sharing the interest is called the grantor. In contrast, the one receiving is called the grantee. When the quitclaim deed is completed and fully executed, it transfers any of the grantor’s interest in the property to the recipient (grantee).

Minnesota Quit Claim Deed is a legal or authoritative form used to give property title in Minnesota’s state. This form provides no legal guarantee that the dealer can transfer the property lawfully or he has an unbound title to the premises.

It proves helpful when you need to transfer the property without wanting to get an attorney or lawyer involved. The Minnesota quit claim deed requires none of the lawyers unless you consult any for some information.

Important Details of Minnesota Quit Claim Deed

The MN quit claim deed does not transfer the property from the dealer to the buyer. Perhaps, it only transfers the title that the dealer has on its name. If we say that the quit claim deed does not have anything to do with actual ownership, it won’t be wrong.

Though the quick claim deed form MN is a straightforward and quick process to proceed with as it transfers all the interest a person has in a property to the other, it does not guarantee what those interests might be. It just transfers all the claims the dealer has with the property to the buyer.

In the quick claim deed MN, a person can be grantor and grantee both side by side. For example, if someone has the property title in his name and wants to transfer half to his spouse, he will list himself as both the grantor and a guarantee and spouse as a grantee only.

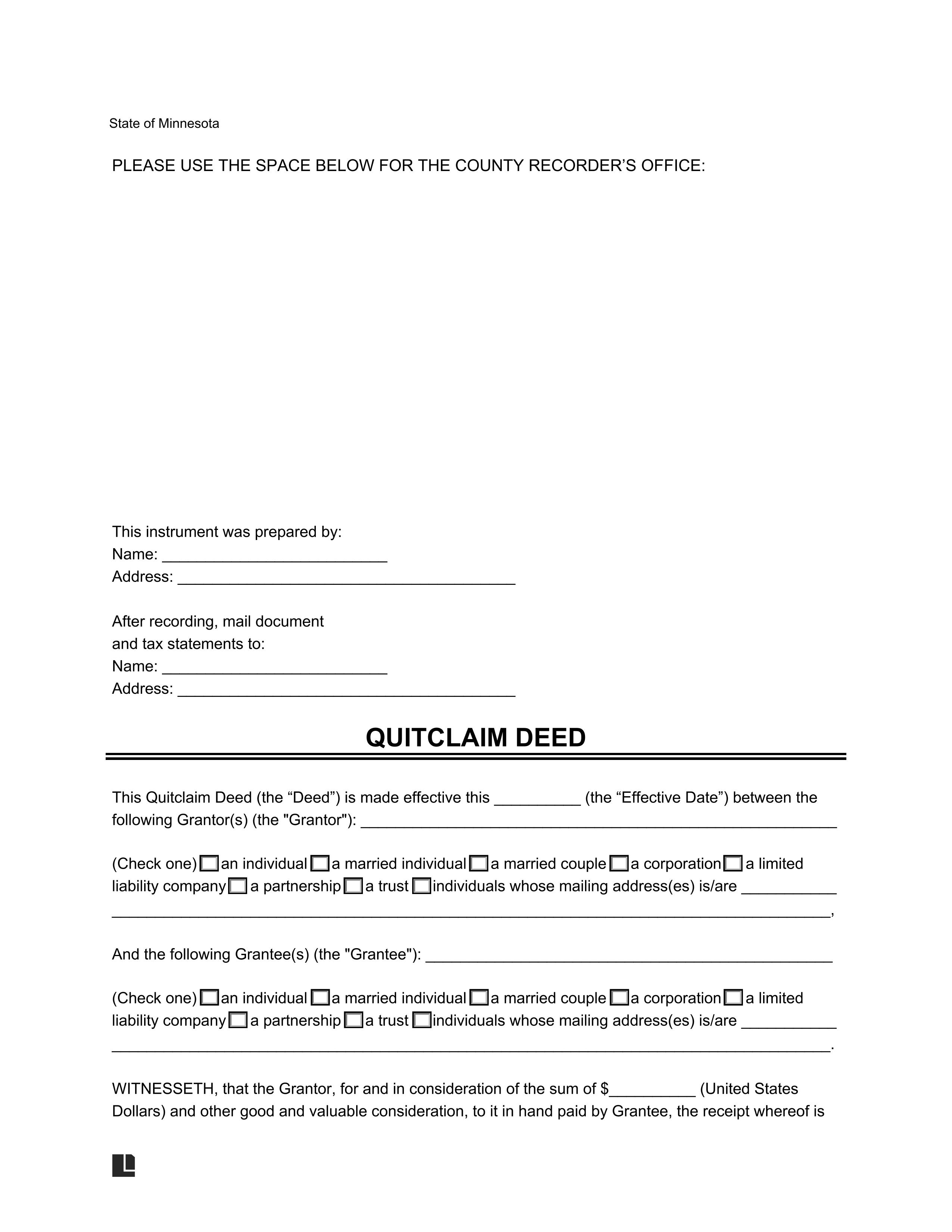

How to Write a Minnesota Quit Claim Deed Form?

Over here, we will discuss how to fill out a quit claim deed in Minnesota. You can fill a Minnesota Quit Claim Deed Form either online, or you can make your own by using the form as a template.

There are few things to keep in mind while dealing with Minnesota quit claim deed form:

1. Always use full legal names when filling out the form. Make sure that you describe the property by address and parcel number. Mention the date and mark the sign in front of a notary.

2. Keep in mind that you have to add correct information about the people involved and the address of the property being transferred as it is required to complete the quitclaim deed.

3. To make the quit claim deed form MN a proper record, take the notarized document to the county recorder’s office and file it with the clerk, paying the demanded fee. It will secure you from any misunderstanding or dispute in the future.

When Will You Need a Quit Claim Deed?

You can need a quitclaim deed MN anytime. By saying anytime, we mean that you want to give your interests in some property to another person. You can do a quit claim deed at any time without even having an attorney involved.

Quitclaim deed Minnesota is mainly used to transfer property within the family members. For example, when a person gets married and is willing to transfer or add a spouse’s name to the deed. Or in other cases, the person gets divorced and wants the title to be removed from the spouses’ name.

Also, when parents are transferring home to their children. It can also be done when the property is being transferred into some living trust. In such cases, a person will need a quit claim deed.

These deeds are not used for the real estate sale because buying the property doesn’t receive any guarantee about the title.

Conclusion

We hope that it may prove helpful for your quit claim deeds by all the information provided above. We have made sure to cover all the points a person should know and have answered the questions that arise when referred to it. Using a quit claim deed can help you save a lot of time as it is quick and convenient to proceed with.