What is a Quit Claim Deed Form?

It's a kind of document which is generally used in property transfer or sharing. Quitclaim Deed Form is a special type of deed that is used to transfer real estate without a guarantee about the title of the property.

A person who transfers property by white-paper deed makes no promise that he owns or has clear title to the property. The person who acquires the property by the declaration deed, whatever interest the owner receives, but no more. The person signing the deed is not responsible if it is discovered that there is a problem with the title of the property.

When to Use a Quitclaim Deed?

It is used in sharing a piece of property or home with someone. In general they are usually the relatives of the owner of the property, or are decided by the owner.

If someone is seeking to transfer ownership of property, a quitclaim deed is a fast and easy method to mull the estate. A quitclaim deed is a document that is used to transfer ownership of real estate from one party to another. Quitclaim deeds are also sometimes called quit claim deeds or quick claim deeds because they are a fast way to accomplish real estate transfers.

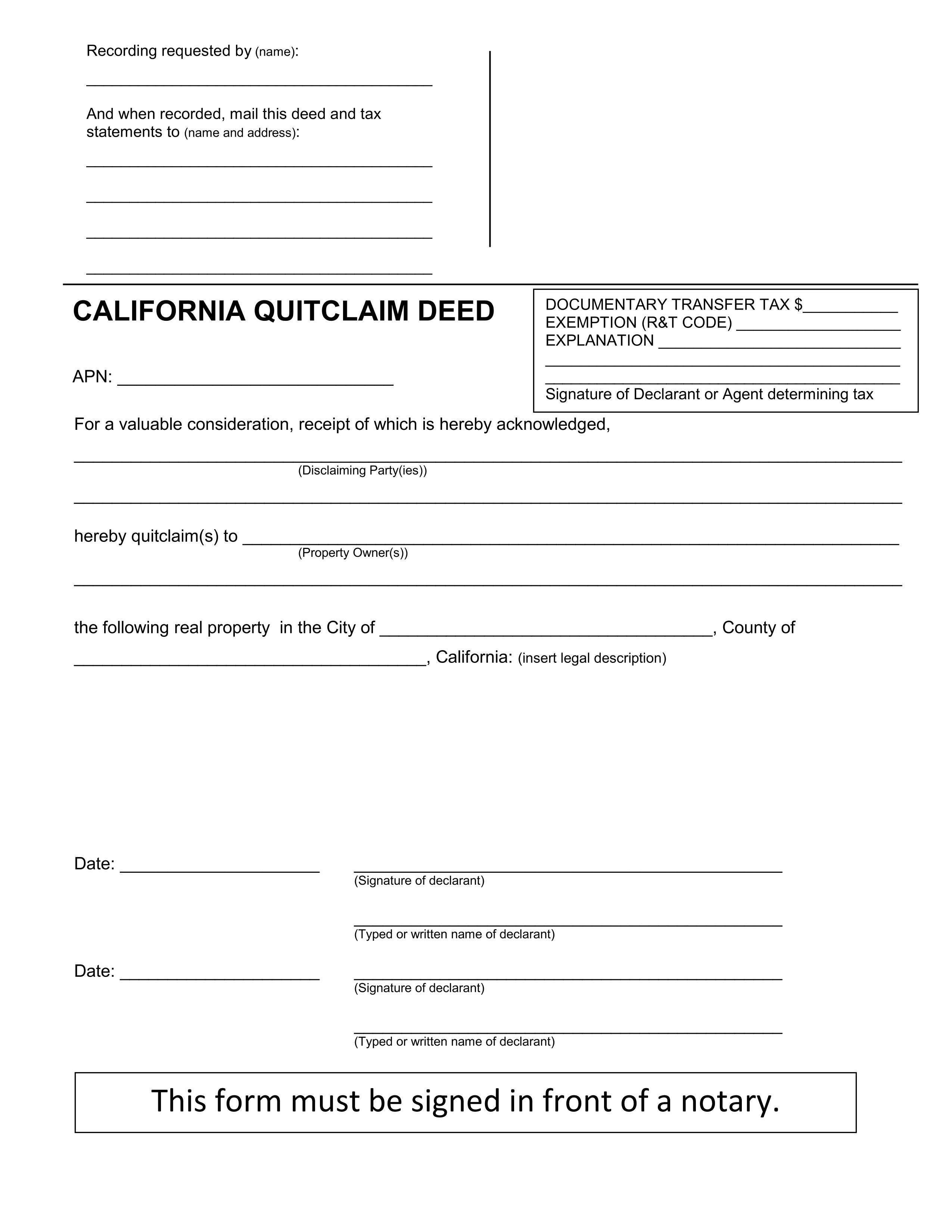

How to Write a Quitclaim Deed

The quitclaim deed is a legal document (deed) used to transfer interest in real estate from one person or entity (grantor) to another (grantee).

A quitclaim deed transfers title but makes no promises at all about the owner’s title. A quitclaim deed transfers the owner’s entire interest in the property to the person receiving the property but it only transfers what he actually owns, so if two people jointly own the property and one of them quit claims his interest to his brother, he can only transfer his half of the ownership.

Steps of Quitclaim Deed

- Write the title "quitclaim deed" in bold text.

- Write the date of the transfer of property.

- Write a short description that shows what is transferred, from who and to whom. All these can be contained in a sentence.

- Write the amount paid for the property. This is optional as it can be substituted based on real estate principles of privacy.

- There should be a "consideration" statement that makes the document legally binding

- The quitclaim ends with the signatories and date.

Important Facts About Quitclaim Deeds

No warranty included

As with the other two types of deeds, the grantor receives certain warranties when it acquires ownership of the property. Typically, these warranties include a promise that the grantor has proper ownership and the right to sell the property, as well as a warranty that the grantor will defend the grant against adverse claims of ownership from other parties that arise. Can.

Grantee is just like pawn

Just because the grantee is not creating a warranty, it does not mean that you should never accept work that leaves a claim. First, in many situations the grantor does not require (or care for) the warranty. For example, it is useful when excluding claims where there is a strong trust between the parties, such as a transfer between family members or between business subsidiaries. Perhaps you want to keep your own property in a trust or transfer it to a sibling. They are also useful when dividing property after a divorce.

Used as Title Flaw

Use them to fix the title flaw: it generally depends on the particular state.

Title defects are commonly used to remove title defects or "clouds". Clouds often arise when a title search reveals that the property was moved improperly. For example, a previous owner may have failed to follow the correct legal requirements and format for the deed. When a person may have an unexpected interest in the property, a cloud may possibly arise, possibly a granting property that is transferred without the consent of their spouse, who also had an interest. In this case, the spouse who still has a potential interest may be asked to execute a testamentary claim to relinquish any right to the property.

They Do Not Affect the Mortgage:

Typically, claims to quit are not used to transfer a property that has an existing mortgage on it. This is because they are commonly used with property that is not being sold, but has simply been transferred. Where the property has an existing mortgage, purchasers generally insist on obtaining transfer warranties from the grant which are contained in a general warranty deed.

Conclusion

A person who signs a quitclaim deed to transfer property they are actual mutual partner of the property.The quitclaim deed only transfers the type of title you own.

However, this does not mean that abandoned claims are never used to transfer property that has an existing mortgage. In such situations, however, it is important to note that the abandoned claim deed will not affect the mortgage.

Overall Quitclaim deed is a good approach for the dealings of properties and estate. Following the guidance and consults of the deeds form is the prime thing to run any kind of Quitclaim in any state.