Are you looking for ways to ensure a successful transfer of a property title? You can rely on sample warranty deeds to assure you that the property you want to buy is free and clear of any encumbrances such as lien and mortgage.

The easiest way to prepare a general warranty deed is through the CocoDoc app. It has free warranty deed forms including the Microsoft word warranty deed template. It offers the most straightforward way to edit, sign and share PDF documents. The hassle-free solution is Google integrated and uses premium security measures to protect your documents.

What Is a Warranty Deed Form & How It Works?

A warranty deed form is a legal document used to transfer property ownership to a new owner. The document guarantees that the title to a real estate property is free from others' interests and no creditors will use it as collateral for the grantor’s debts.

Most instances of title transfers involve two strangers that haven’t met before. Using a printable warranty deed transfers property in the cleanest way possible from the current owner (grantor) to the new owner(s) (grantee).

Once a land conveyance occurs, the new owner is added to the owners’ list as the title’s last known holder. Other previous owners’ details are provided in the list, including their names, property purchase rate, mortgages, and sale date.

A general warranty deed gives the property buyer protection against potential fraud and financial burdens, especially if the seller lacks the authority to sell it. A grantor signs the deed to guarantee the grantee against any title issues, regardless of when they arose.

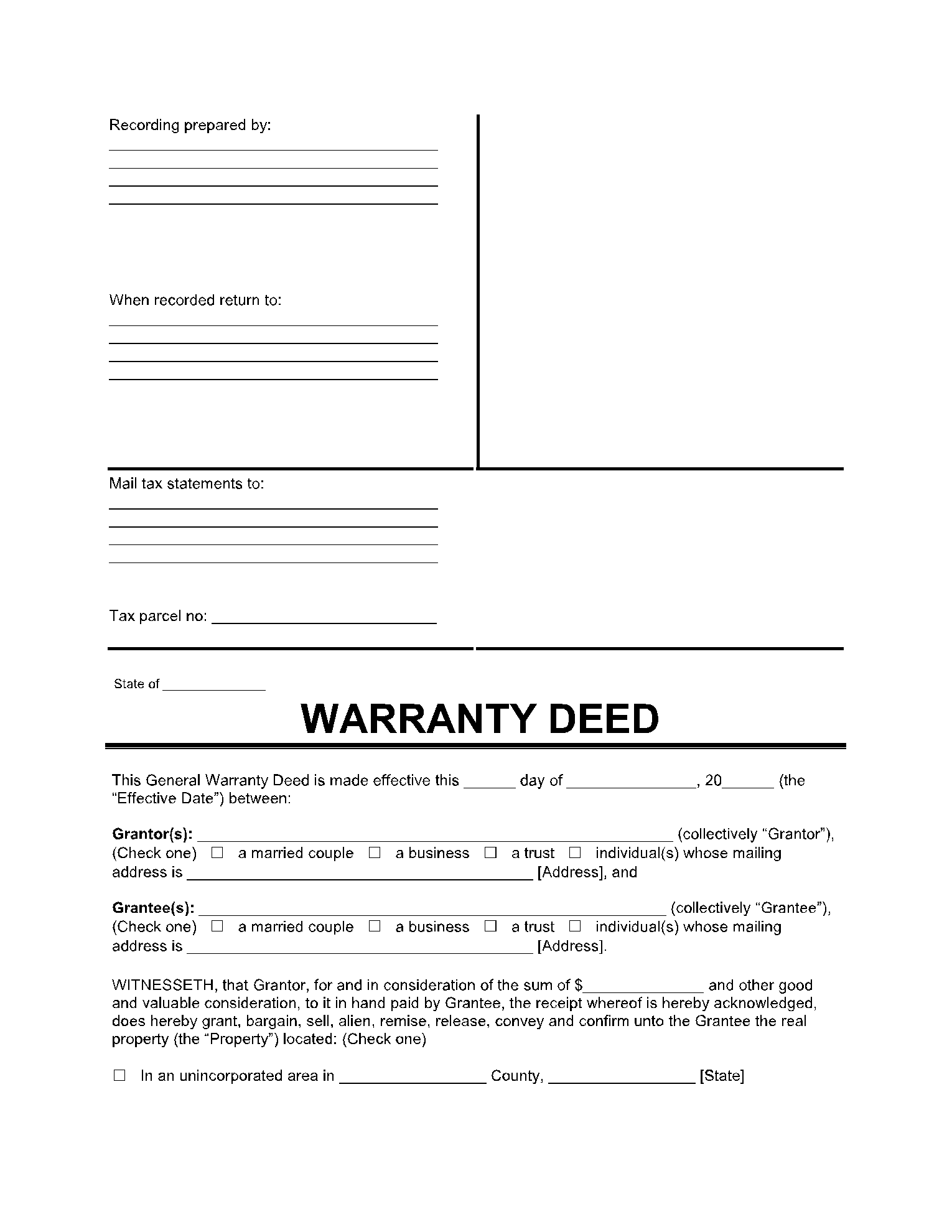

It’s a document you want to see and sign before closing a deal. It spells out the terms of sale, the county where the sale is conducted, the property’s legal description and boundaries, the parties involved in the transfer, and any covenants made to the new and past owners.

Key Components of a Warranty Deed Form

The following are critical components of general warranty deed forms:

- Grantor – a corporation or individual(s) currently owning the property.

- Grantee – a corporation or individual(s) wanting to purchase the property.

- Mailing Address – this is the physical address of both parties and not P.O. Box.

- Joint Tenancy – when transferring warranty deeds to multiple new owners, they are referred to as joint tenants. Each joint tenant owns a share of the overall property and may sell or bequeath their portion if they wish.

- Consideration – the amount of money to be paid for the property, if any.

- Legal Description – this is a legal description to identify which property piece is to be transferred.

- Parcel Number – the parcel number is usually located on the property’s tax statement. If you can’t find it, call or visit the county, city or court office where the property taxes get paid.

- Witnesses – several states require the signing of the deed document conducted in the presence of a witness.

- Notary – the property seller must share the warranty deed form pdf with a notary public for verification and authentication of the signatures.

Other significant components that you may include in a general warranty deed are:

- Life Estate: for tax purposes, a grantor can reserve a life estate interest to continue being the property's legal owner until death.

- Easements: the seller can reserve the right to continue using the property or part of it for various reasons. It could be to drive through to reach another property, etc.

- Mineral Rights: the property seller can reserve any remaining interests such as subsurface gas, oil or other mineral rights.

Types of Warranty Deed Form

Here’re types of warranty deed forms:

General Warranty Deed: It guarantees that the property title is warranted against all possible defects and protects the grantee from fraud by providing the property's entire history. It offers the maximum legal protection and is typically applied when paying for a property.

Statutory Warranty Deed: It's an abbreviated general warranty deed reliant on state laws to define its guarantees.

Special Warranty Deed: This document guarantees against a title's defects when the seller owned the property. It's used when the grantor wants to avoid legal responsibilities for claims against the title.

Warranty Deed V.S. Quitclaim Deed

Unlike warranty deed forms, quitclaim deeds contain no title covenant. They are a straightforward way of transferring the names on the property title. It means you don't have a warranty on the title's status, and if there happen to be any liens, you would be held liable.

When Is a Warranty Deed Form Needed?

Due to the risks allocated by a warranty deed form to the seller, it’s usually utilized in the sale context when a grantor or grantee has the will to purchase title insurance on the property. Property title insurance protects buyers while lessening risks on the grantor.

It’s rare to use a general warranty deed form outside the sale context. Suppose the grantor wants to give property away. In that case, they usually aren't comfortable providing a full warranty of the title that would make them liable for unknown issues with the title.