Though many California residents have executed Deeds of Trust on their homes or real estate properties, few are entirely aware of what they are. They have a vague resemblance to mortgages and secured loans for the acquisition of real estate.

There is a nagging fear that the lender will seize the property through the Deed of Trust if one does not pay. When pressed, however, most citizens are unaware of a document that is likely the single most important document in terms of imposing rights against them that the law permits.

Deed of Trust California: What Is It?

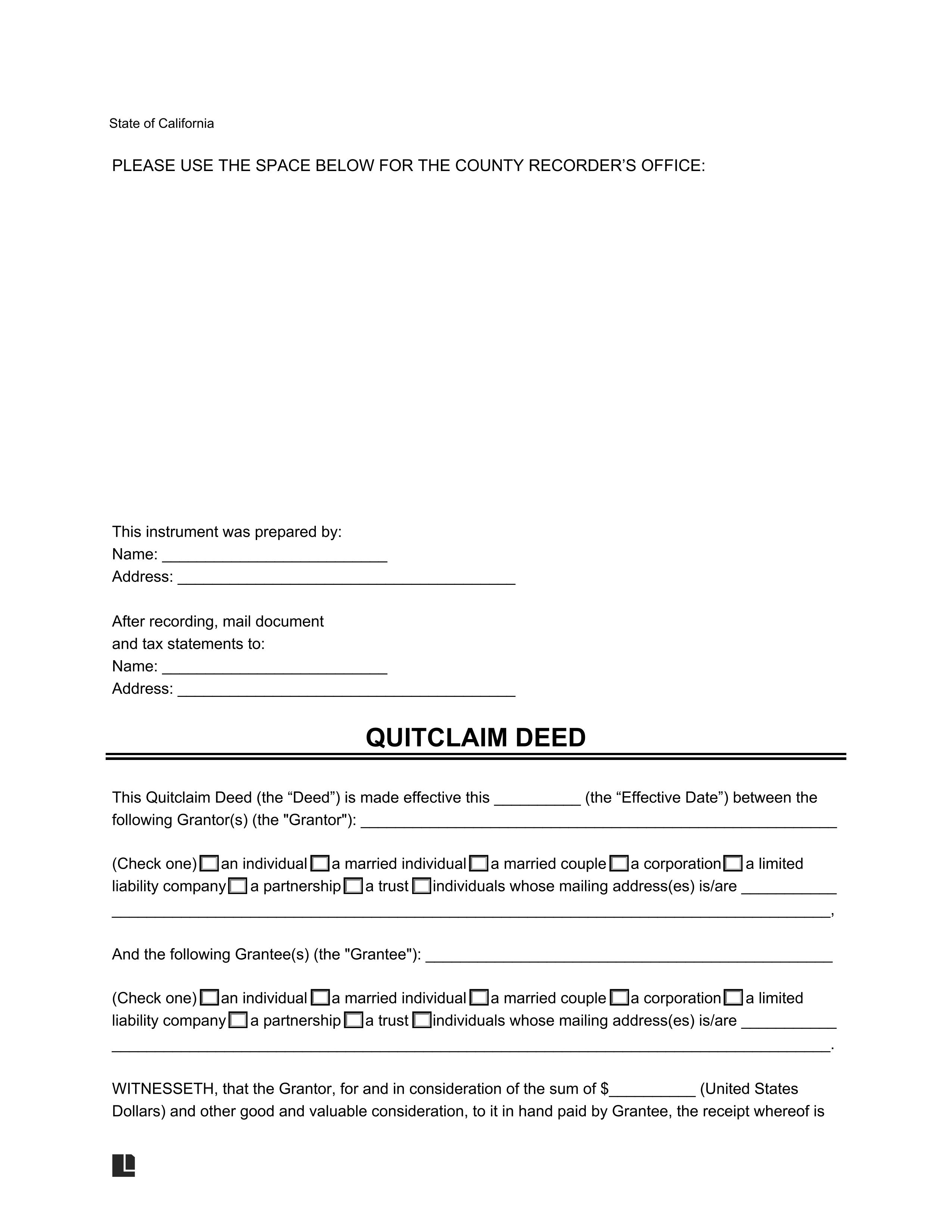

A deed of trust in California is a legal document used to transfer property in real estate. Three parties, including the borrower, the lender, and the Trustee for the property, may collaborate on the deed of trust form. The acts of trust in California will also provide personal information about these individuals.

To pass property and begin funding, this deed of trust form may be used instead of a mortgage. It may also be used to finish loans for purposes other than real estate. Since a deed of trust deals with money, it's essential to provide as much detail about payments and due dates as possible. Since a deed of trust may be a legally binding contract, it must be precise and competent.

Key Elements of Deed of Trust California

Some standards must be included in this instrument, regardless of the form of Deed of Trust being used. It has to:

- Put it down on paper.

- Have an amount that corresponds to the note's amount(s)

- Have a date that corresponds to the note's date(s)

- Have a full legal definition of the encumbered property(s)

- Have the Beneficiary's name, which must exactly match the Payee's name on the note(s)

- Have the Trustor's name, which must exactly match the Payor's name on the note(s)

- Have the Trustee's name, which must be identical to the Trustee's name on the note(s)

- Have a mailing address for the Trustor so that notes can be mailed in the event of a default.

- Have a good return address for the Beneficiary if you need to send the document back after being registered.

- The Trustor's signature and notarization are necessary on the California deed of trust form.

How to Write a California Deed of Trust Form?

Follow these measures to create a deed of trust in California.

- The appropriate names, addresses, and other party details involved in the transaction will be filled in the first section of the trust form deed.

- You'll enter one or more legal explanations of the property in the next section. Suppose you don't already have the legal property description. In that case, you can get it by calling or going online to the county register or recorder of deeds and having the property address or tax parcel number.

- After that, you'll enter the key repayment terms. These can be found on the promissory note and will be agreed upon in advance by the parties.

- Finally, you will have the opportunity to include any additional terms and conditions. This is primarily so that you can use any non-standard terms that the parties have agreed to.

- The parties sign and date the agreement in the presence of a notary or witnesses to put it into effect.

- While recording is not always necessary, it is strongly advised that you do so as soon as possible to protect yourself from any future adverse claims to your title by others. Any deed of trust should be filed with the appropriate local office, commonly referred to as the County Recorder's or County Clerk's Office.

Why Do You Need it?

The primary reason for using a short form deed of trust in California is to maintain legal records of the various financial contributions made when two people invest in real estate. However, it may be used for a variety of other purposes, such as recording the following:

- The sum of money each person contributed to the land.

- Each of their property shares is worth a certain amount of money.

- When one of the two people has contributed more money in the future, for example, for renovations

- The share of bills, maintenance, and mortgage payments that each of the two investors is responsible for.

- When a third party, such as a friend or family member, has invested money but is not listed on the title deed and wishes to protect the amount of money they have invested.

- When one of the two investors is unable or unwilling to buy out the other and wishes to relinquish their interest in the land, a formal agreement is made.

Conclusion

A trust deed, also known as a deed of trust, is used to secure a real estate loan. Legal title to a property is passed from the lender to a neutral trustee before the borrower pays off the debt with a trust deed. The legal title passes from the Trustee to the borrower until the repayment is made and the transaction is complete.