A grant deed form is a legally binding document that permits property transfer from one individual to another. In certain countries, a grant deed form is also known as a special warranty deed. They must be notarized and filed with the county in which the property is located in most states.

Grant Deed California: What Is It?

A grant deed California is a legal document that transfers ownership of real property. A grant deed form must include the name of the individual or entity transferring the property, a legal description of the property, and the identity of the person or entity receiving the property. A special warranty deed is another name for a California grant deed.

The grantor, or the property owner who wants to transfer ownership, guarantees that the property has not been offered to someone else and that there are no hidden liens or limitations on the property. The grantee is the property's new owner. The grant deed form must be notarized by a notary public, who will charge a small fee.

Important Details of California Grant Deed

California grant deeds guarantee the beneficiary only two things:

- that the deed's transferor has not already transferred the land title to someone else

- Except as otherwise stated in the contract, the property is free of liens and encumbrances.

As a result, a grant deed form:

- Declares that the title is conveyed free and clear of any disputes that could have arisen when the grantor (the deed transferor) possessed the title.

- All identified liens and other encumbrances on the property have been revealed, according to the statement.

- In practice, this means that any burdens of title created by the transferor should be disclosed in the Grant deed form: assessments, conditions, covenants, and restrictions; any liens and leases; easements, encroachments, and rights of way. There are no personal taxes or other legal or financial problems that may make selling the property challenges.

How to Write a California Grant Deed?

Follow these measures to create a California Grant Deed.

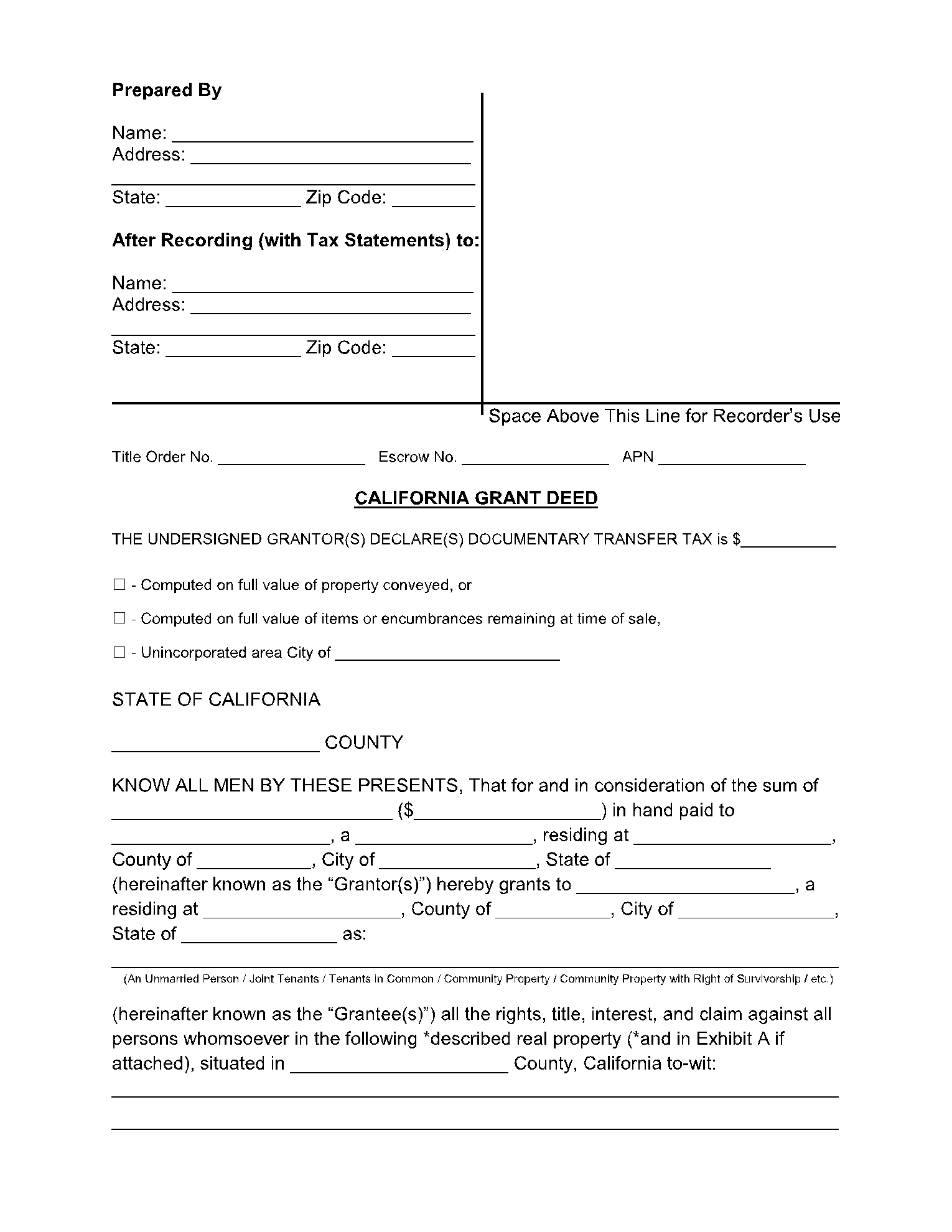

Step 1: Get the California Grant deed form.

Step 2: Fill in the person's name and address, filling out the form, and the name and address of the person who will receive the completed deed and other statements.

Step 3: Write down the Assessor's Parcel Number for the land, which you can get from the county assessor's office.

Step 4: Fill in the necessary blanks with the grantor's name in the CA grant deed.

Step 5: Write the property's county and area, followed by the property's legal description. This should include the address and explanation from the original deed of the property.

Step 6: Go to a notary public with the completed California grant deed form. In the presence of the notary, have the grantor sign the California grant deed form 2018.

Step 7: Register all of the records at the County Recorder's Office. The transfer tax sum will be entered in the required box by the County Recorder's Office.

Grant Deed vs. Quitclaim Deed

The preferable deed for a buyer is a grant deed (also known as a "warranty deed"). Grant deeds form to transfer property to understand that the buyer will not be held liable for any unidentified ownership disputes in the future.

Instead, if a lawsuit is made against the land, the seller will be held liable. Grant deeds form to ensure that the seller conveys the property with "marketable title," which provides that the title is free and clear of all other claims or encumbrances.

A quitclaim deed, on the other hand, contains no guarantee against potential ownership claims. It only conveys the seller's interest in the property as is, regardless of any unidentified ownership claims. A quitclaim deed tells the buyer that the seller has no claims to the marketable title.

When land is passed from two joint owners to one, quitclaim deeds are commonly used. When families (e.g., spouses or other relatives) transfer ownership of a property, or when a property owner transfers her property to a trust, this practice is normal.

Conclusion

A grant deed form is a legal document used to transfer property from one individual to another in a specific transaction. The Grant deed California includes assurances that the land has not been sold to anyone else and is free of liens.

The state will have its requirements for preparing a legitimate grant deed. Still, most conditions, including California, will include a written document that describes the parties, provides the land's legal description and includes language granting the title.