What is a California Transfer on Death Deed Form?

The transfer on the death deed form permits you to transfer property to the new owner if the one who owns it dies. Everything is done automatically as there is no need to go through the procedure of transfer.

The transfer on death deed California allows the new owner to control the property, like the right to alter their mind about the transfer. A particular kind of language is specified to make sure that the deed qualifies as a TOD deed. It is also known as a transfer-on-death deed or simply a TOD deed.

Criteria for Transfer on Death Deed in California

There are a few terms and conditions that are essential to know about so you could have a clear cut idea about the criteria of transfer on death deed California form. Remember that California’s tod deed has a few limitations considered to be the form’s main criteria.

The limitations are on the kind of property that can be transferred through this deed, like a single-family home or condominium unit, a residence with not more than four people living, or a single-family residence on agricultural property 40 acres or less.

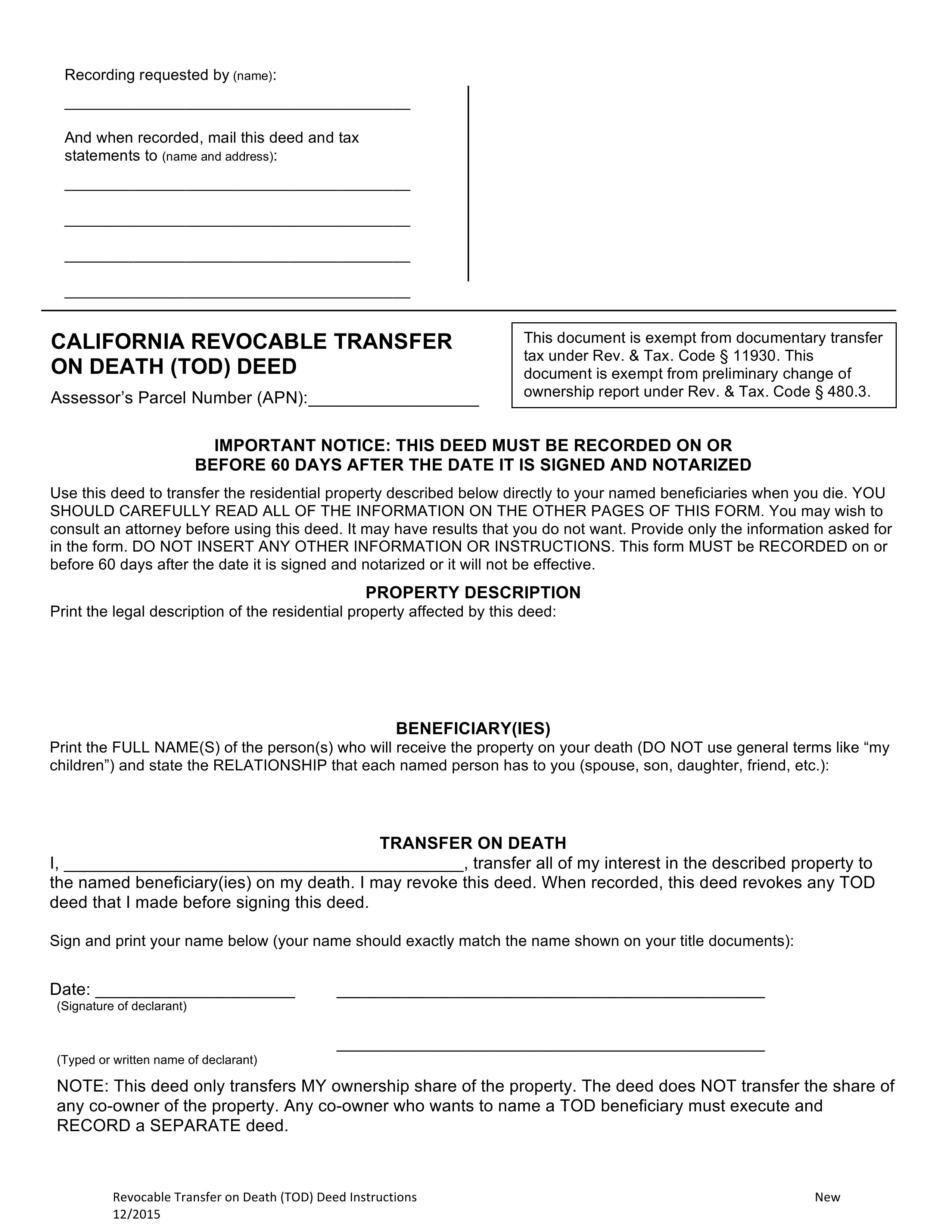

A revocable transfer on death deed California form must be signed and dated before you go for a notary public to make it effective and valid. It is recorded within 60 days or less than that from the date it is signed, and, as its name indicates, the revocable TOD deed can be revoked by the transferor at any time they need to.

How to Write a California Transfer on Death Deed Form?

The California transfer on death deed form can be written by keeping in mind a few main things like you should know that it applies on residential property. A proper legal description should explain the property here. The owner should have all the rights and knowledge of signing the form and be well aware of the consequences.

Tod deed form California is supposed to be signed, dated, and notarized after that, and the name of the beneficiaries should be stated as their real names. One most important thing is that the transfer on death deed California should be the one that is made by keeping in mind the rules of the state, so experts should design it.

Conclusion

Transfer on death deed form is an essential part of today's life, and many people are looking forward to it. If you didn't think about it before, then we hope you would like to try out this now as it is beneficial for many reasons.